Depreciation is one aspect of the tax code that facilitates greater investment in renewable energy and ultimately lower costs for consumers.

Bonus depreciation on solar panels.

More importantly i don t know your whole situation but i feel like you are eligible for a form 3468 investment credit for your solar panels.

Macrs solar accelerated depreciation what is the macrs depreciation benefits of solar panels.

The tax benefits of solar panels and the low cost of generating your own electricity make for the perfect way to save.

168 k 1 a the depreciation deduction provided by sec.

On june 5 2018 the united states tax court ruled in favor of the petitioner taxpayer in claiming the solar energy credit under sections 46 and 48 and macrs bonus depreciation under section 168 k 5.

The new bonus depreciation rules define qualified property as tangible personal property with a recovery period of 20 years or less.

Because the largest percentage of most renewable energy property i e wind and solar is personal property that is otherwise 5 year modified accelerated cost recovery system macrs property and because the new law did not change the general rule for.

167 includes a special allowance for qualified property for the tax year in which the property is placed in service.

Team up with raywell solar and change the way you get your power.

Macrs depreciation is an economic tool for businesses to recover certain capital costs over the solar energy equipment s lifetime.

It looks like solar panels have a 5 year life.

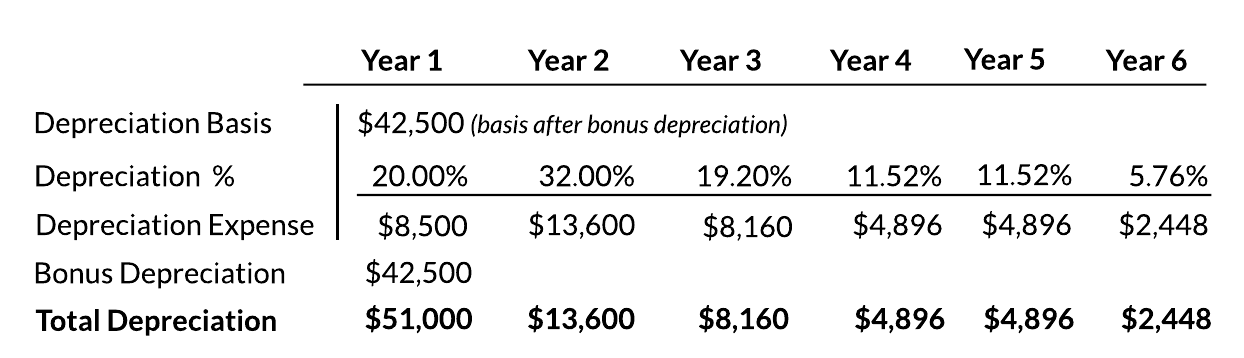

Normally the depreciable life of solar panels is 85 of the full solar system cost which may be depreciated roughly as follows.

Thus the court determined that the basis in the solar equipment for 2011 was 152 250.

Businesses rely on policy certainty to make long term investment decisions.

Now is the time to switch your home or business to solar.

Seia supports smart tax policy that drives continued innovation in the solar industry.

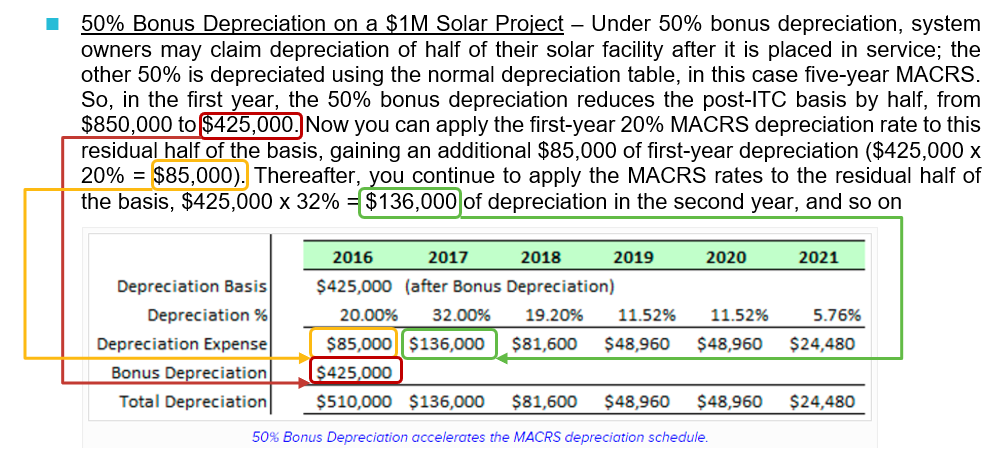

0 89 1 000 000 890 000 to calculate the bonus depreciation for a solar pv property placed in service in 2023 the business multiplies the depreciable basis by 80.

The tax cut and jobs act of 2017 brought with it the option for 100 bonus depreciation on solar systems which is often a great way for businesses to quickly recover costs associated.

Allowing businesses to deduct the appreciable basis over five years reduces tax liability and accelerates the rate of return on your solar investment.

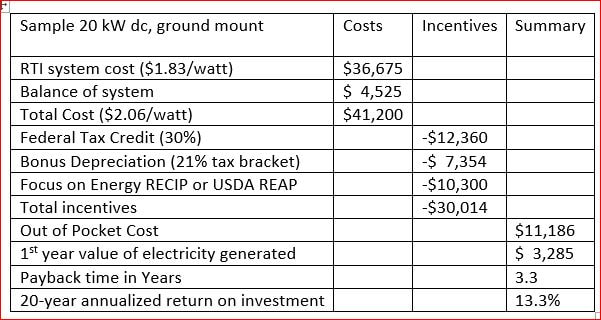

Depreciation on solar panels is one of the easiest ways businesses and farms looking to go solar can keep installation costs down rois high and paybacks short.

However this year you can use 100 bonus depreciation if you would like to take the full cost as depreciation expense in 2018.

If you re looking for ways to save money around the home or office solar energy can be a great option.